Atelier WeekNotes w/c 7 Oct 2024

Help on Influential Trajectories. 0/DETECTING. Event: A Roadmap to Impact for Family Offices. ReadingNotes. Deep Transitions Framework; Systemic Investment; The Seductions of Declinism.

I am writing newsletter of #weeknotes of starting the Atelier of What’s Next (a studio for initiatives at the frontier of generating a better future). For my rationale for starting the Atelier see here.

Another week busy with my family challenges means no project updates, but lots of exploring the frontier of investing for a sustainable future (with lots that is relevant to the Influential Trajectories method.

This week covers:

REQUEST. Influential Trajectories: invitation to test a user's guide

0/DETECTING

-Event: A Roadmap to Impact for Family Offices

#ReadingNotes (Finance-related)

-TRANSFORMATIVE INVESTMENT IN SUSTAINABILITY: An Investment Philosophy for the Second Deep Transition

-TransCap's Definition and Hallmarks of Systemic Investing

-'The Seductions of Declinism' by Will Davies, LRB

How can the Atelier of What's Next be of service to you, and your purposes? We'd love to hear from you. Perhaps you have a challenge or idea to put in the studio. Maybe one of our existing topics appeals to you. What if you love to make new things happen by being part of the studio? Or if you have feedback or comments that would improve this deck. Either click the button below or email davidbent@atelierwhatsnext.org.

REQUEST. Influential Trajectories: invitation to test a user's guide

In the coming weeks I will be writing an Influential Trajectories users guide, as an output of the work with the Sustainable Shipping Initiative. I'd love to test (drafts of) the user's guide. If that could be with you or your organisation, get in touch (davidbent@atelierwhatsnext.org).

As a reminder, Influential Trajectories is a way to create shared commitment to investments and initiatives that drive towards transformative outcomes. It does this by getting many actors across a situation to imagine different trajectories from today to a future goal together (informed by latest systems transition theories). They come up with tests for each trajectory to see if the pre-conditions for exist. Then they use the evidence to create a portfolio of investments and initiatives

The key thesis is that people are more willing to commit to investments and initiatives where they have devised the test of whether to proceed themselves. ('Oh, I had thought everything was ready for Trajectory A, but it isn't. We'll just watch that. I was sceptical of Trajectory B, but it jumped my high hurdle. Let's put effort into that.')

Acknowledgement: I am very grateful for the opportunity to create the Influential Trajectories approach that was provided by Sustainable Shipping Initiative (SSI), and funding from Lloyd's Register Foundation.

If you'd like to try Influential Trajectories out in your sector or situation -- help me write the user's guide and yourself to stir for systemic change -- then get in touch.

0/DETECTING

Event: A Roadmap to Impact for Family Offices

Recently I was invited to an event on 'Family Offices: A Roadmap for Impact', hosted by Conduit Connect, an investor in early-stage impact entrepreneurs*, and Cazenove Capital, a wealth management firm that is part of Schroders.

(*DISCLOSURE: I have a investments of <10% of my net worth in the Conduit Connect EIS.)

The centrepiece was a new report from the Impact Investing Institute (III), an "independent, non-profit organisation with the goal of making capital markets fairer and work better for people and the planet". The report was on “Family Offices: A roadmap to impact”. Thanks to one of the speakers from Cazenove, Emilie Shaw, I can share some of the slides with you.

According to the III report, Family Offices are "vehicles set up to manage and invest wealth and other assets that families might require if they have significant means". The opening line of the introduction shows what's at stake:

"The $10tn of impact-interested capital held by family offices globally is in a unique position: no other institutional asset owner has more freedom to invest for positive impact than a family office."

The ironies abound. The regulations that are supposed to protect pensioners-to-be push their investments into companies with good short-term returns, but enormous externalities which will make life terrible for anyone who actually gets to be a pensioner. The people who have discretion over investments, and so can make a difference, are those who have accumulated ‘significant means’ under that same status quo.

According to the experts in the room, the other important feature is that there is about to be wealth passing down to next generations in coming years, estimated at a $30tn (according to the Cazenove slides). The older folk made the money. The younger folk are the ‘purposeful generation’ (we hope).

So, a huge opportunity to increase impact investing.

Cazenove use a similar specrtum as others to distinguish the different types of investment (I use something similar in my lecture at UCL; good news is I won't need to up date that part):

For Cazenove, investing is impact investing when the asset has material pro-impact revenues from, was purchased intentionally for impact reasons, the investors provides financial and non-financial support, and the investor can measure the impact achieved. These are pretty high hurdles, especially compared to the completely arms-length transactional investing of the mainstream.

The report itself was highly praised by folks from Family Offices in the room. The authors had interviewed a number of people in family offices, and had insights based on real experience (rather than advocating at the audience).

One key distinction was between those setting up a family office from scratch to have impact ('impact by design') versus those which already exist and there is a desire for 'shifting to impact'. This resonated with attendees, as did acknowledging the family dynamics. (If you think your Christmas meals are tense, then add in where one part of the family wants to re-orientate where your money is invested towards do-gooding woker-y.)

The report has a good series of steps from a family to go through (starting with 'realisation that drives a new direction') and pointers on how to advocate internally for impact (you won't be surprised that hectoring doesn't really work).

The folks at Cazenove were adamant that going for impact investing had no opportunity cost; you would not be giving up on returns. Their own fund Sustainable Growth Fund has outperformed non-impact alternatives (do not take this as investment advice, value of investments can go down as well as up, etc, etc):

(As with my reflections on the Systemic Investing Hallmarks, there is something weird about requiring market rates of return if you believe that the current market is investing in activities which are destroying the basis for civilisation, and the current market returns rely on those externalities. But I guess that is the price of entry, in some way.)

There was lots to admire in all of this. When I chair of EIRIS Foundation, we developed the 'pioneering the next steps for sustainable finance' strategy on the idea of maturing the expectations and services of particular niches, in that case charities, to then be ready to shift the mainstream, when there is a window of opportunity.

There is a parallel possibility here: developing and proving impact investment in the Family Office niche, so there is a track record, skills and product offerings which can go to other investor types. The next step would be to look at the processes to develop that nice, selecting from Transformative Outcomes.

Even so, the way Impact Investing is conveyed in the report matches with the critiques in the #ReadingNotes below. For the Deep Transition Framework, impact investing is co-opted into system optimisation. While for the TransCap's Systemic Investing is when "investors…take a stance about the future direction of a system's evolution in a way other forms of purpose-driven finance do not."

In the 20+ years I've been involved in sustainability, there's always been the Current Thing, and the Next thing. The Current Thing (which used to be the Next Thing) has been taken up by early and first adopters. When it was first emerging, it addressed an important critique in the then-Current Thing, and looked like it might be a complete solution. But now, as the Current Thing, it is clear it has flaws. Fortunately, the up-and-coming Next Thing looks like it addresses those flaws and might be a complete solution.

In the world of 'business and society' over the last 20 years we've had: Corporate Social Responsibility (CSR), Corporate Responsibility (CR), Corporate Sustainability, and then a whole opening up into Regenerative Business, Circular Economy, Donut Economics and so on. (You used to be able to tell when a company started doing stuff based on the name of the department.)

In my lecture on sustainable finance, there are various categories of pro-sustainable investing: Financial-only, Responsible, Sustainable, Impact, and Philanthropic. (The Cozenove diagram simplifies this a little.)

My guess is that in a few years' time there will be an extra column 'Systemic' or 'Transformative', to stand for investment which goes beyond system optimisation to actively aiming for socio-economic reconfiguring. It is the Coming Thing.

Finally, whenever I am engaging with finance, I do think of Will Davies' response to the Resolution Foundation's report Stagnation Nation. The full quote is below, but ends with explaining why there has been so little investment in the UK over the last 10 years: "To put it bluntly, Britain’s capitalist class has effectively given up on the future".

Well, the capitalist class who were there at the event hadn't given up on the future, and were actively exploring what they could do to invest in a better future (without missing out on returns). Two cheers for them. The tough, crucial question: how to make them go from a minority to a majority?

WHAT NEXT

Nudge Conduit Connect, and Cazenove, on the Systemic Investing / Deep Transition agendas.

Work out what role, if any, for the Atelier of What's Next, and the Influential Trajectories method, in all this.

#ReadingNotes (Finance-related)

These two items are summaries from the #ReadingNotes series, see here for more (including format and use of bulletpoints).

TRANSFORMATIVE INVESTMENT IN SUSTAINABILITY: An Investment Philosophy for the Second Deep Transition

Transformative Investment in Sustainability: An Investment Philosophy for the Second Deep Transition (here) is a brilliant application of the latest conceptualisation of massive economic change in history to our current challenges. It is aimed at investors.

The diagnosis: almost all current 'sustainable investment' (/ESG / impact investing) practice is aiming at system optimisation. This will not be sufficient to address the challenges we face. Instead, we should learn from the Industrial Revolution, which the authors call the First Deep Transition, and subsequent surges. The lessons from history, and current policy practices, are described in a Deep Transitions Framework, which puts a huge emphasis on the 'rules' (from habits and assumptions through to standards and laws) which actors use to guide their behaviour.

The most important sentence: "the first necessity for investors engaging with Deep Transitions thinking is to focus on whether an investment and its indirect consequences contribute to systems changes that address social and ecological goals at a fundamental rather than cosmetic level."

My version: how is your investment driving industrial revolutions on a deadline? I'm guessing answer, for the vast majority of even so-called impact investing, will be 'hardly at all, and if so, not deliberately'.

The report uses the Deep Transitions Framework, and practical experience to have three implications for investors, and 12 principles.

The implications:

Shift the perspective to the transformative potential of investments.

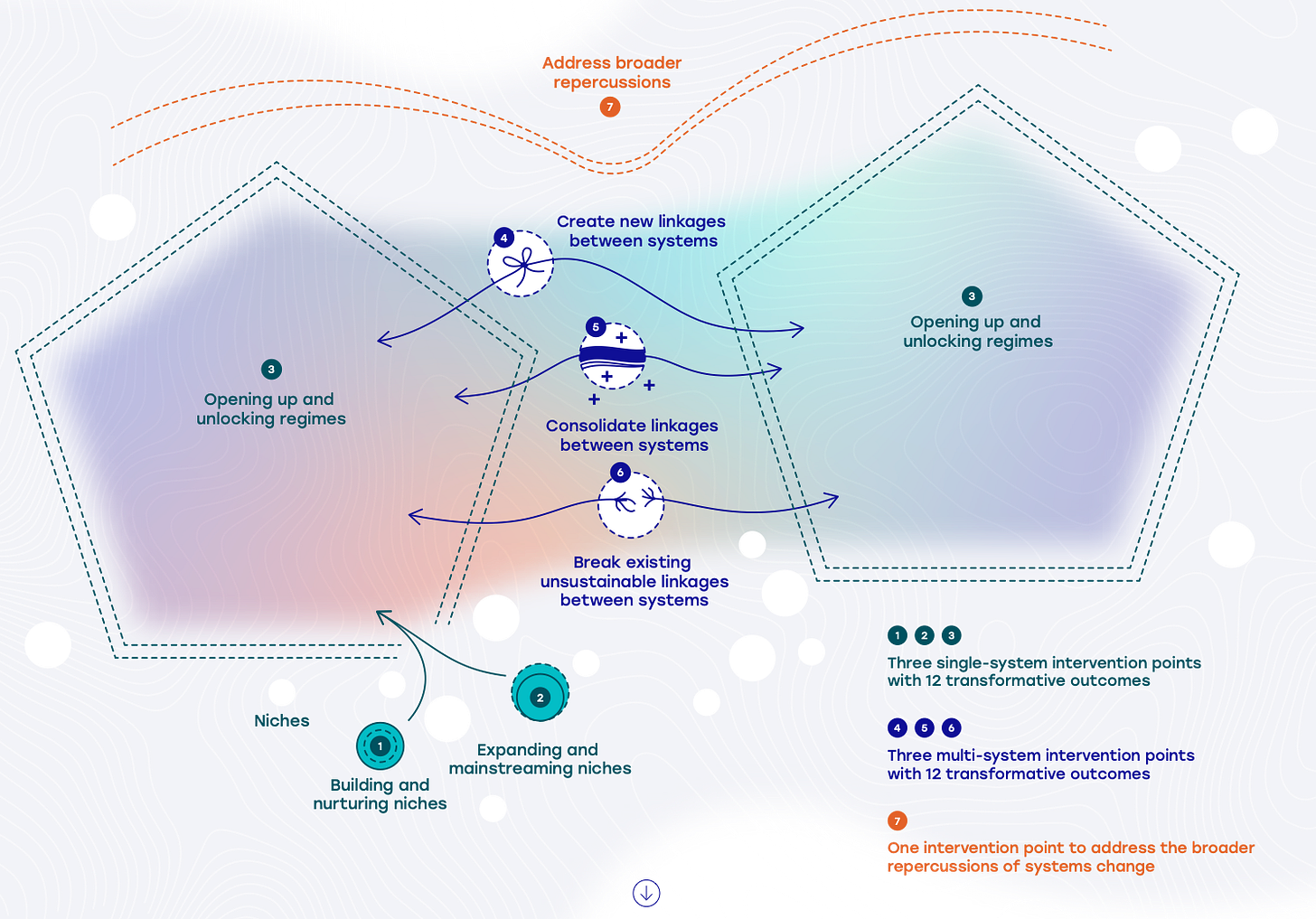

Deep Transitions thinking identifies three categories of intervention points (which should be used as a compass, rather than a steering wheel):

Three intervention points focused on single-system change. Following Transformative Outcomes.

Three intervention points focused on multiple-system change: transferring, diffusing and linking change across multiple systems, including through the development of niche clusters.

One intervention point to address the broader repercussions of systems change from the perspective of a just transition.

Collaborate to transform.

There is a huge amount of this which I have already been inspired by, and will be using in my own work, especially:

Rules as way to describe systems. It puts the emphasis on the patterning, and what is keeping the patterning similar over time, rather than on the individual parts.

Making every Theory of Change a Transformative Theory of Change.

As with any approach, there are aspects to critique.

There are two really big claims, which are are in my view highly contestable. Firstly, that the Second Deep Transition is already underway. I hope so, but, if is, then we will not know definitively in my lifetime (failure we will know earlier). Second, that the Second Deep Transition will emerge concurrently around the world, and will not need diffusion. While we live in a more globalised society than ever before, this runs against historical experience and the mechanism for this emergent magic is not explained.

On a more technical level, the mention of visioning puts too much emphasis on the destination compared to the journey, and the intervention point for a Just Transition felt like a worthy request by the authors (one I agree with, morally), rather than a necessity based on historical evidence.

More profundly, the framework shows its inheritance from modernity in some fundamental assumptions: being to have universal models; a modus operandi which smells of controlling complex change (saying we need to embrace uncertainty is not the same as showing that in the waft and weave of the method); the way nature is missing from the mechanics of Deep Transitions (while being fully present in the case for action); and a blindspot on the role and dynamics of culture.

Finally, the presumption behind this work is that global finance can go from neoliberalism's enforcer to sustainability's enabler. Fingers crossed on that.

Even so, this is a brilliant piece of work which I will be using weekly going forward.

ReadingNote continues here.

WHAT NEXT

Integrate into the theory and practice of the Atelier.

TransCap's Definition and Hallmarks of Systemic Investing

The TransCap Initiative (Transformative Capital Initiative) is a "collaborative innovation space for building the field of systemic investing". They have done us all a huge favour by trying to bring some working definitions, concepts and practices to the emerging space of systemic investing in their new-ish publication 'Definition and Hallmarks of Systemic Investing' (here).

Their working definition: "Systemic investing is the deployment of financial capital to transform human and natural systems with the intention of advancing environmental sustainability and social justice.”

A huge contrast with current practice, as "Systemic investing requires investors to take a stance about the future direction of a system's evolution in a way other forms of purpose-driven finance do not."

To add structure and detail to the definition of systemic investing, they have developed 12 Hallmarks of Systemic investing (names in the table, explanations in the full entry; *=content hallmark; ^=process hallmark):

I very much agree with the need for investors to take a view on the future direction of a system. Too much of what is called sustainable investing is not aiming for the industrial revolutions on a deadline that we need. As the report hints, there is something weird about requiring market rates of return if you believe that the current market is investing in activities which are destroying the basis for civilisation, and the current market returns rely on those externalities.

The approach is more generic compared to Deep Transition Framework, which has an embedded 'view' on how socio-economic systems change. I worry that leaves the TransCap Hallmarks more open to greenwashing or cooptation.

The more serious critique comes from how the System Analysis and it sub-Hallmarks are carrying a heavy, heavy burden. It is as if Systemic Investing requires being able to do near-perfect systems analysis in advance. So, much like the Deep Transitions Framework, it says that we should act as if the world is deeply uncertain, but then it describes practices which assume that we can use analysis to identify cause-and-effect in advance. (In Cynefin terms, it is talking as if in a Complex situation, but acting as if it is a Complicated one.)

For me, there is also too much as if the investor is the one and only prime mover in any situation. The combinatorial and nesting role with government policy, or with huge landscape-level trends, is under-cooked. Again like Deep Transition Framework, the approach is a bet that global finance can move from neoliberal enforcer to sustainability enabler. Fingers crossed!

Even with the critiques, this is a brilliant piece of work which I will be using in the development of Influential Trajectories and elsewhere.

ReadingNote continues here.

Citation: TransCap Initiative, Definition and Hallmarks of Systemic Investing, Zurich (CH), August 2024. here [accessed 11/10/2024]

WHAT NEXT

Integrate into the theory and practice of the Atelier.

'The Seductions of Declinism' -- Will Davies, LRB

Just over 2 years ago, noted political economist Prof Will Davies responded in the London Review of Books to Stagnation Nation, a report from think tank Resolution Foundation that was part of its attempts to influence the political weather in the dog days of the last Tory government.

This passage really hit home for me:

"The picture painted by Stagnation Nation is familiar from the work of many political economists, such as Brett Christophers and Jodi Dean, who have tracked the drift of contemporary capitalism towards ‘rentierism’ and even ‘neo-feudalism’.

"What these terms suggest is that economies like Britain’s have effectively abandoned the pursuit of prosperity through the traditional capitalist practices of investment in technology, R&D, skills and entrepreneurship (all of which offer a reason and a means for businesses to increase wages), and descended instead into passive speculation on unproductive assets, above all housing, but extending to such Ponzi schemes as NFTs and other cryptocurrencies.

"This tendency can be dated back to the explosion of financial services in the late 1980s, but has become acute in the years since the 2008 financial crisis, when – for reasons that aren’t entirely clear – an abundance of very cheap credit, which could have been used for the creation of new firms, new production methods, whole new business models, was instead used to inflate the value of existing assets even further.

"One reason that highly unequal, low-productivity economies tend towards stagnation is that wealth management strategies of the sort pursued by the super-rich become largely defensive, aimed at preserving and exploiting existing assets, rather than risk-taking.

"The Resolution Foundation is quite praising of recent government efforts to increase the rate of investment in the public sector, but despairs at the extraordinarily low investment in the private sector.

To put it bluntly, Britain’s capitalist class has effectively given up on the future." [emphasis added]